NTI’s Phase I/II Rett Syndrome clinical trial results improve upon $2.4BN capped Neuren’s results…

Disclosure: S3 Consortium Pty Ltd (the Company) and Associated Entities own 8,410,000 NTI shares and 350,000 NTI options at the time of publishing this article. The Company has been engaged by NTI to share our commentary on the progress of our Investment in NTI over time.

Strong results just announced...

Enough for FDA approval?

FDA approval helped one company more than 10x in share price.

Our biotech Investment, Neurotech International (ASX:NTI) just announced additional data from its Rett Syndrome clinical trial today.

Rett Syndrome is a rare genetic neurological and developmental disorder that affects the way the brain develops in very young women.

Rett Syndrome symptoms are horrible and permanently life altering for both the patient and caregivers.

Today’s NTI data release includes info on a secondary endpoint called the Rett Syndrome Behavioural Questionnaire (RSBQ).

RSBQ is completed by the caregiver, and is one of the most widely used efficacy measures in clinical studies of Rett Syndrome due to its specificity to the core features of RTT. (Source)

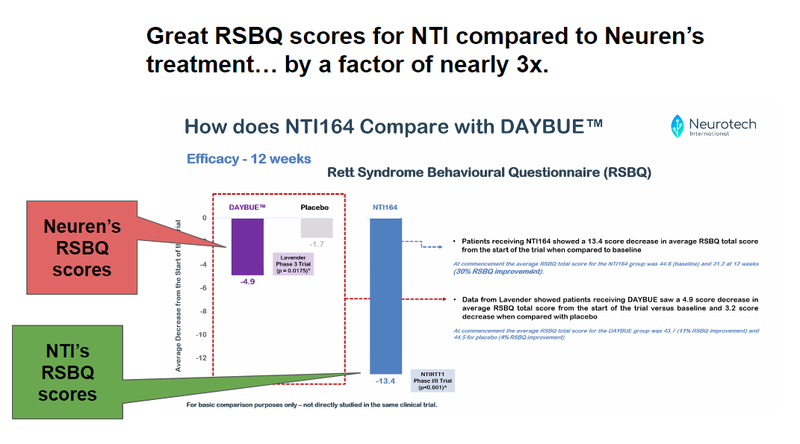

The headline here is that NTI’s treatment scored very well in comparison with Neuren’s RSBQ scores - by a factor of roughly 3.

More on this later...

for now the results look very strong to us.

Across one metric - roughly 3x better than a treatment which is already FDA approved.

FDA approval of a treatment for this disease has already taken a company called Neuren Pharmaceuticals from a market cap of ~$100M to ~$2.4BN in the space of 3 years.

Meanwhile NTI is currently capped at $92M with ~$14M in cash after quickly completing a $10M raise at 10c when it released its first clinical trial results for Rett Syndrome and excellent Autism Spectrum Disorder (ASD) results at the same time last month.

(We bid $150k in this raise and got scaled back to $70k)

To talk through the results in more detail, NTI MD Dr Tom Duthy will be presenting to investors over zoom at 12pm AEST today, you can register to attend here.

NTI is seeking to emulate the success of Neuren by providing a viable alternative to $2.4BN Neuren’s treatment.

Neuren achieved an incredible feat for this niche, debilitating childhood disorder.

It’s a model for success that NTI is quickly chasing down with each new bit of positive clinical data that the company releases.

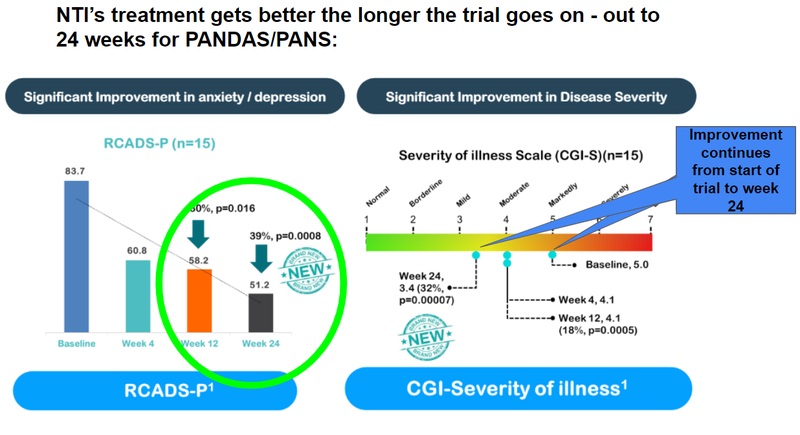

We know from previous clinical trial results across other disorders (Autism and PANDAS) which NTI is treating with the same compound, that the treatment’s efficacy usually gets better as time goes on.

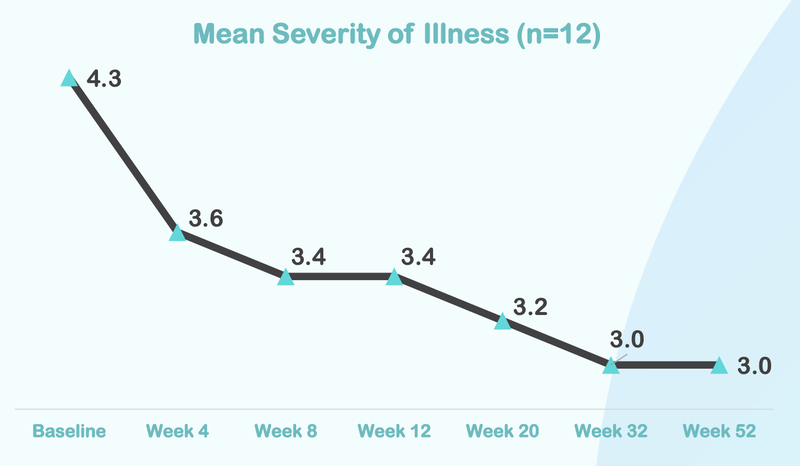

With NTI’s Phase I/II Autism Spectrum Disorder - the treatment worked increasingly better through to the 52 week mark:

With another Phase I/II trial on a rare paediatric condition called PANDAS/PANS the results also improved through to week 24:

NTI is working on a thesis that the company’s treatment works on neuroinflammation and if that is true - we think further Rett Syndrome results could improve on today’s data which came at the 12 week mark.

In short - we think NTI has a good chance of getting even better results through to week 24 or 32 (depending on the timing of data releases) in the Rett Syndrome trial based on what has been achieved in NTI’s other trials.

All up, we think today’s results further underline NTI’s potential for an FDA approved treatment for Rett Syndrome and the basis for a larger re-rate than we have already seen.

NTI is up ~100% in 8 months, since we Invested at 4.5 cents in September of last year - we Invested again in the recent 10c capital raise as well.

NTI is now well funded for what will come next - we’re hoping engagement with the Therapeutic Goods Administration (TGA) is the starting point for a step change in the company’s trajectory on the charts.

Today we’ve got the following updates on NTI:

- More on NTI’s latest Rett Syndrome clinical trial data

- What’s next for NTI

- Risks

More on NTI’s latest Rett Syndrome clinical trial data

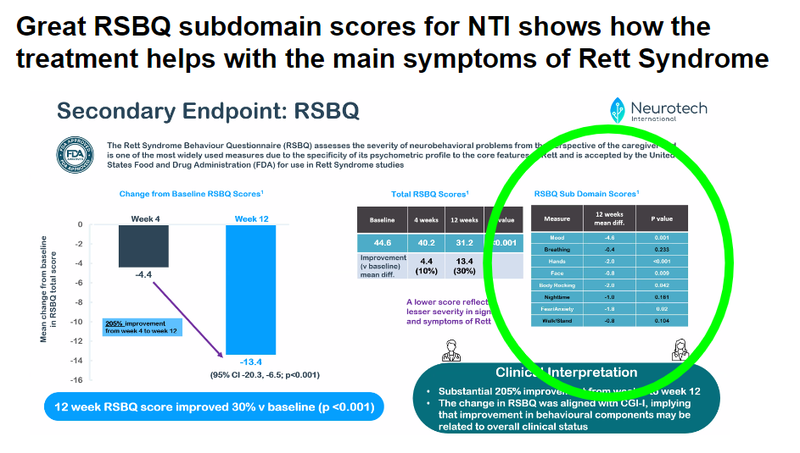

The key secondary endpoint we are focussed on in this latest NTI data release is the results across the Rett Syndrome Behavioural Questionnaire (RSBQ).

RSBQ is completed by the caregiver, and is one of the most widely used efficacy measures in clinical studies of Rett Syndrome due to its specificity to the core features of RTT. (Source)

The headline here is that NTI’s treatment scored very well in comparison with Neuren’s RSBQ scores - by a factor of roughly 3.

Below is NTI’s RSBQ performance relative to Neuren’s performance:

(Source)

That’s a sizable improvement.

And today, NTI released data that shows NTI’s treatment’s effects across “subdomains” of the RSBQ:

(Source)

These are the aspects of Rett Syndrome that make the disorder so difficult for the patient and caregiver - things like:

- delayed development milestones,

- loss of motor skills,

- seizures,

- intellectual disabilities,

- sleep disturbance,

- behavioural problems,

- social anxiety,

- poor coordination,

- and vision problems

To our knowledge, Neuren did not release data about the various subdomains of the RSBQ.

NTI is building a case here - and it looks like it deserves credence.

The additional bonus is this - we’ve seen across NTI’s previous successful clinical trials on Autism Spectrum Disorder (ASD) and PANDAS/PANS (which were both extended) is that improvement is incremental well past the 12 week data which NTI is presenting here today.

As we mentioned before - the longer patients are on the treatment in other trials the better the effects.

It makes sense too.

As the dosage of NTI’s treatment builds up in the patient’s bloodstream, the greater the therapeutic effect.

We’ve seen NTI release additional positive data well beyond the 12 week mark in previous studies on PANDAS/PAN and ASD.

For us, it stands to reason that the results from the Rett Syndrome trial could well improve as time goes on.

We already knew that NTI’s treatment for Rett Syndrome met the primary endpoint - which means this clinical trial was a success.

Click here to read our note on the initial Rett Syndrome results

But the latest data provides NTI with more evidence that its treatment is effective - which is particularly useful as it enters discussions with the regulator.

The first regulator that NTI will be talking to is Therapeutic Goods Administration (TGA) which will provide NTI with guidance across all of its treatments - we think this will include Autism Spectrum Disorder (ASD), a disorder called PANDAS/PANS which NTI has already hit the primary endpoint for, and Rett Syndrome.

Currently there are around 200 Rett Syndrome patients in Australia - importantly, these Rett Syndrome patients are not able to access Neuren Pharmaceuticals treatment because it has not been approved by the TGA.

In short - Rett Syndrome patients in the US can access the ~$2.5BN market capped Neuren’s treatment, but Australian patients can’t as of yet.

We’ve previously discussed the potential safety drawbacks to Neuren’s treatment, which was the main subject of a recent short report.

Click here to read our take on this short report

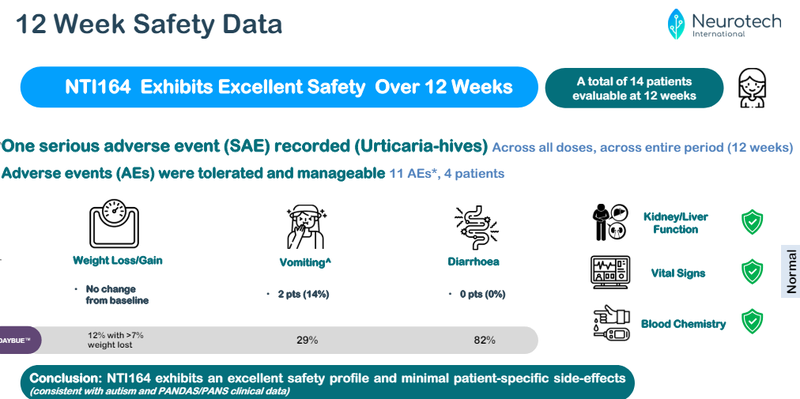

We think that today’s data continues to paint a strong safety picture for NTI’s treatment, with comparably efficacy across the primary endpoint, and significantly better efficacy across what we view as the most important secondary endpoint.

(Source)

While there was one serious adverse event where hives occurred with NTI - there were ZERO patients with diarrhoea which happens in 82% of patients taking Neuren’s treatment.

The severity of the diarrhoea we think is a major pain point for doctors prescribing Neuren’s treatment - one of the side effects discussed in a recent short report on the company.

Neuren did a wonderful thing by getting an important treatment into the hands of patients and caregivers.

What we’re saying today though, is that NTI has a good chance to improve upon that treatment and in doing so, improve the lives of patients and caregivers.

The key will be more rigorous, larger datasets and further clinical trials to ultimately win over the regulators.

The early signs are definitely good here though, and in light of Neuren’s Orphan Drug Designation - there is a probabilistic value attached to NTI also securing Orphan Drug Designation.

Neuren secured an Orphan Drug Designation and a Rare Paediatric Disease Priority Review Voucher which is very valuable and can fetch large sums of money, these can be on-sold and are worth roughly $100M. (Source)

🎓Learn: Orphan Drugs Explained

Orphan Drug Designation has been correlated with share price re-rates across many companies over time. (Source)

We’d expect a similar thing to happen to NTI - should the company get it.

What’s next for NTI?

As we said in our last note, NTI has always been good at signalling clearly what newsflow is to come, and delivering that newsflow on time.

Meeting outcome - TGA Regulatory Advice

Given the ASD results, we expect NTI will engage with the Therapeutic Goods Administration (TGA) in Australia to see if the TGA supports the treatment entering the market. We think NTI will also discuss its PANDAS/PANS trial and Rett Syndrome trial with the TGA as well - Rett Syndrome patients in Australia currently do not have access to Neuren’s Daybue treatment.

Metabologenomic data from Phase I/II PANDAS/PANS Clinical Trial

This is actually quite important - this is another measure of how well NTI’s treatment works for another rare paediatric disorder called PANDAS/PANS.

Results have already come back positive for this disorder in October of last year - this could show the method of action of NTI’s treatment, further strengthening its case for entry to market.

Read about PANDAS/PANS:

NTI’s clinical trial meets primary endpoints for neurological disease

Orphan Drug Designation Europe - Rett Syndrome

Orphan Drug Designations are valuable. If the EU gives the all clear, this catalyst could re-rate NTI’s share price.

🎓Learn: Orphan Drugs Explained

Orphan Drug Designation Europe - PANDAS/PANS

Same applies for PANDAS/PANS

Orphan Drug Designation USA - Rett Syndrome

The US healthcare market is incredibly lucrative - US Orphan Drug Designation for Neuren played a major role in its 2000% re-rate. Neuren secured an Orphan Drug Designation and a Rare Paediatric Disease Priority Review Voucher which is very valuable and can fetch large sums of money, these can be on-sold and are worth roughly $100M.

Orphan Drug Designation USA - PANDAS/PANS

Same applies for PANDAS/PANS in the US.

Completion of Patient Recruitment Phase I/II Cerebral Palsy

We expect NTI to start recruiting for this trial which could add another big string to NTI’s bow.

NTI already has Human Research Ethics Committee (HREC) approval and Clinical Trial Notification (CTN) scheme clearance by the Therapeutic Goods Administration (TGA) for this trial.

Cerebral Palsy is a group of permanent movement neurological disorders, appearing in early childhood.

It impacts muscle coordination and motor-neuron skills, but can often impact other body parts too. No two people experience CP in the same way.

Market opportunity: An annual drug therapy market of US$4.3BN.

Rare disorder - potential orphan drug designation could make NTI’s treatments lucrative.

At the moment there are only two FDA approved drugs available.

Commence Phase I/II Cerebral Palsy Trial

Starting the trial would open up another catalyst for NTI on results.

FDA IND/EMA toxicology

US FDA Investigational New Drug and European Medicines Agency toxicology reports will hopefully show that NTI’s treatment is safe in the human body - this can only strengthen NTI’s case for market entry.

Presentation of Phase I/II Rett Syndrome data at international Rett Syndrome conference

Neuren previously presented its results here - we’d like to see NTI do the same to build support for its treatment in the broader Rett Syndrome community.

Risks

Regulatory risk:

We see the upcoming discussions with EU and US regulators about Orphan Drug Designation for PANDAS/PANS and Rett Syndrome as key catalysts - regulators could decide that NTI’s drug does not qualify.

Orphan Drug Designations are very valuable and can be on-traded for cash or kept by the company.

If NTI doesn’t get these designations, then it could hurt the NTI share price.

Market risk:

Broader market sentiment for small pre-revenue biotechs could get worse and the sector as a whole trades lower, taking NTI’s share price with it. Alternatively, the entire market could sell down as well.

We note extremely heightened geopolitical tensions, and the potential for a wider conflict in the Middle East.

World events could drag the NTI share price lower, even if it does everything right.

Our NTI Investment Memo

In our NTI Investment Memo you’ll find:

- Key objectives for NTI

- Our long term NTI Big Bet

- Why we are Invested in NTI

- What we want to see NTI achieve

- What the key risks to our Investment

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.